Covid-19 has undeniably had mixed impacts on the commercial property market. While some areas have felt the effects more strongly than others, the industrial/ logistics sector has witnessed exponential growth in the last year in a marked difference from others.

Regardless of the reasons for this surge in demand, the knock-on impact remains the same; increased demand has resulted in higher rent prices for occupants, and therefore the returns that property owners stand to lose if anything goes wrong are now even greater. With this growth expected to be sustained into the long-term, this highlights the importance of commercial latent defect insurance with loss of rent included.

As James Polson, National Head of Industrial and Logistics at LSH commented, “While the future of demand in other property sectors is clouded in uncertainty, the role of logistics in the post-COVID world appears assured. The market has been turbocharged over the last year. COVID-19 has accelerated structural changes in consumer and business behaviour that will continue to drive high levels of occupier and investor demand for logistics property over both the short and long term”.

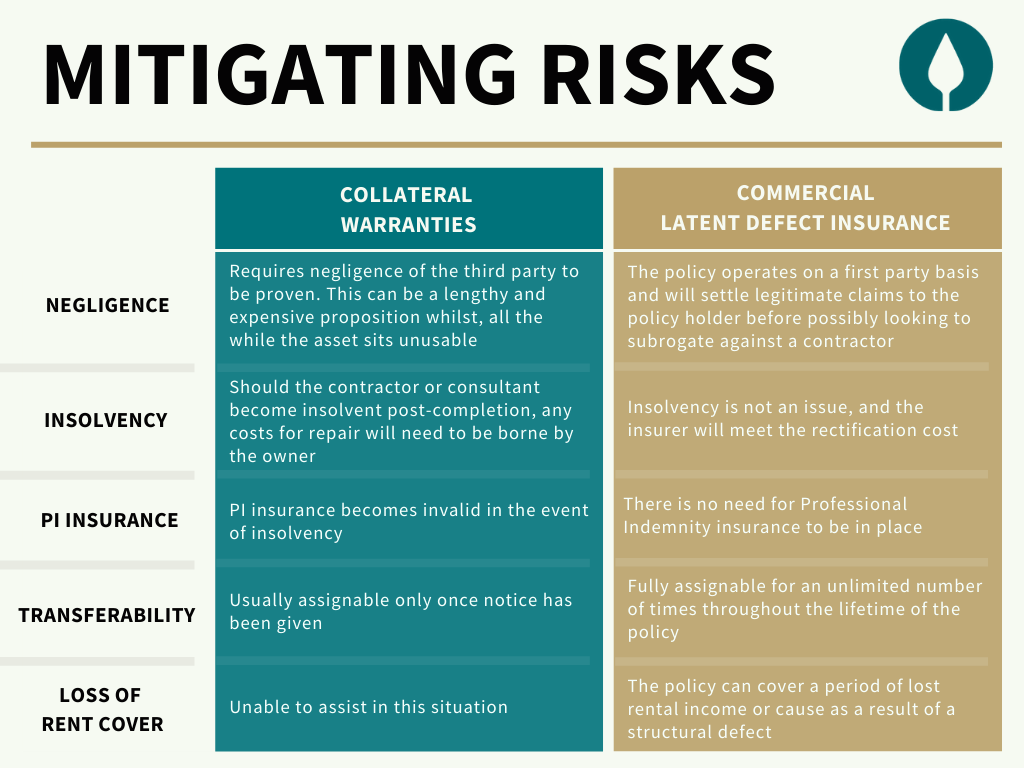

Historically, developers have relied on collateral warranties alone to settle claims following damage caused as a result of a structural defect. However, not only can this be an expensive process if settled through the courts, it is also a time-consuming activity with no immediate relief provided to the property owner. Therefore, property owners find themselves with an unusable asset and unable to fulfil their obligations to tenants.

Gabriella Chapman, Senior Broker, adds, “With Commercial Latent Defect Insurance in place, property owners can ensure that in this event, they can safeguard their rental returns without having to prove negligence. Today in a sector where rent prices are expected to remain in the region of £7-8 per sqm, the benefit of commercial LDI has never been more apparent.”

Latent Defect Insurance Vs Collateral Warranties:

Latent Defect Insurance for Commercial & Residential Properties

London Belgravia has made a name for itself in the LDI and Building Warranty market as an independent and impartial specialist in both the residential and commercial fields.

If you’d like to schedule a call to discuss how Commercial Latent Defect insurance can reduce exposure to collateral warranty or PI claims, please do not hesitate to get in touch