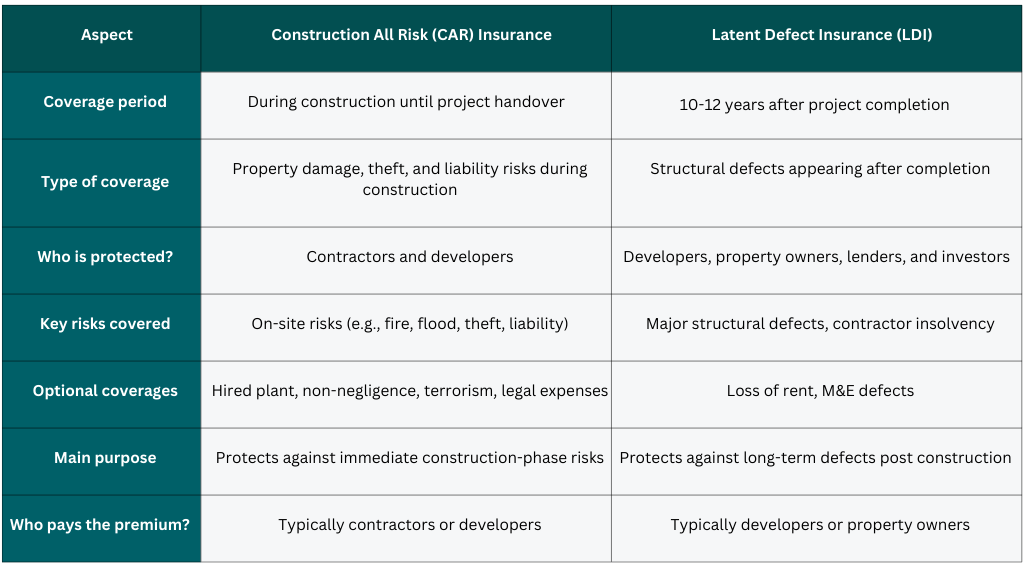

Both Construction All Risk (CAR) Insurance and Structural Warranties (also known as Latent Defect Insurance, or LDI) are crucial for protecting construction projects, ensuring compliance with lender requirements, and safeguarding against financial losses, but they serve different purposes and cover distinct types of risks.

Understanding the differences is essential for anyone involved in construction or property development. Both types of coverage address key risks at different stages of a project. LDI protects against long-term structural issues post-completion, while CAR safeguards against damage, theft, and liabilities during construction. Fundamentally, these insurances work together, which is crucial for ensuring comprehensive risk management and financial security throughout the lifecycle of a project.

Matt Percival breaks down the key financial and legal protections LDI and CAR insurance offer developers and contractors.

Construction All Risk (CAR) Insurance

CAR insurance is designed for contractors and developers working on construction sites. It provides financial protection against a wide range of risks, including damage, theft, and liability claims, ensuring that contractors can continue projects without suffering financial loss.

Key Features:

- Coverage Period: CAR covers the project during the construction phase, from the start of work until completion and handover.

- Risks Covered:

- Damage to the construction works from causes like fire, flood, or theft.

- Liability for third-party injuries or property damage.

- Damage or theft of contractor’s own plant, equipment, and materials.

- Coverage for hired-in plant and equipment.

- Employee tools coverage.

- Public and product liability.

- Non-negligence insurance (JCT 6.5.1).

- Optional terrorism and legal expenses insurance.

What benefits does CAR offer:

Both contractors and developers benefit as it protects against risks that occur during the construction process.

- Peace of Mind: Offers financial security for contractors working in high-risk environments, ensuring they can complete the project without loss.

- Asset Protection: Covers building materials, machinery, tools, and equipment from damage or theft.

- Business Advantage: Contractors with CAR insurance are more likely to secure contracts as it provides reassurance to potential clients.

Protect your project DURING construction with CAR:

- Covers damage or loss to the project itself and assets during construction.

- Third-party liability protection for accidents or damages caused on-site.

Structural Warranty / Latent Defect Insurance (LDI)

LDI, also known as a Structural Warranty, provides protection against major structural defects that appear after the completion of a project. It helps mitigate long-term risks associated with faulty construction, even after the contractor’s involvement has ended. Available for residential and commercial developments.

Key Features:

- Coverage Period: Typically covers defects for 10-12 years following the practical completion of the project.

- Risks Covered:

- Structural defects in the building that are discovered after completion, such as foundation issues, roof defects, or major construction flaws.

- Contractor insolvency, protecting property owners if the contractor is no longer around to address issues.

- Optional coverage for loss of rent if defects render the property uninhabitable or unusable.

- Can cover mechanical and electrical (M&E) systems and any associated loss of rent due to defects.

What benefits does LDI offer:

For developers, property owners, lenders, and investors this coverage is especially important for meeting funder requirements and providing long-term financial protection for the building.

- Protection Against Contractor Insolvency: LDI provides a safety net in case a contractor is unable or unwilling to rectify major defects, eliminating the financial risk for developers and property owners.

- Transferability: Fully transferable to subsequent property owners, adding value to the asset.

- Effective Sales Tool: Adds security and confidence when selling properties to future buyers or investors.

Protect your project AFTER construction with Structural Warranty:

- Protects the building’s structure from defects that appear after construction, ensuring that the owner is not financially responsible for major repairs.

- Provides long-term security and peace of mind, especially for investors and lenders.

Ensure comprehensive risk management throughout a project’s lifecycle

- CAR Insurance is essential for protecting construction sites and projects from damage, liability, and other risks during the building phase.

- LDI offers long-term protection after the project is completed, covering defects that may arise, ensuring the building’s structural integrity and financial security for owners and investors.

Both CAR and LDI are complementary forms of insurance, providing full coverage from project start to years after completion. Depending on your role in the project (contractor, developer, or investor), both may be necessary for comprehensive risk management.

The expert consultants at London Belgravia Group play a pivotal role in providing bespoke advice tailored to each project, ensuring you secure the right combination of warranties and insurance to meet both lender requirements and financial security needs. By working with their team, you can navigate the complexities of these insurances and ensure that your project is protected from start to finish.

Looking to secure competitive insurance coverage for your next project? Get in touch with Matt Percival today for impartial advice.