When overseeing a large-scale development project, ensuring the proper warranties are in place is critical for both financial security and long-term project success. Recently, a discussion arose regarding the type of warranty a contractor is providing for a £30 million prime residential scheme, and this highlighted some critical distinctions between collateral warranties and structural warranties.

Matt Percival, Senior Consultant, breaks down the key differences between these collateral and structural warranties and why choosing the right type for your project is crucial.

What does a Collateral Warranty offer?

A collateral warranty is a contractual agreement between the contractor and the property owner, which offers some recourse in the event of defects. However, it falls short in several key areas, especially compared to a structural warranty. Here’s why a collateral warranty might not be sufficient:

1. Contractor Dependency: A collateral warranty is only valid if the contractor is still trading. If the contractor goes out of business, the property owner is left without any protection.

2. Professional Indemnity (PI) Insurance: The warranty hinges on the contractor maintaining PI insurance. PI insurance is typically renewed yearly, meaning the warranty could become invalid if the contractor fails to renew it.

3. Legal Burden: To benefit from a collateral warranty, the client must prove negligence on the contractor’s part, which often leads to a long, costly legal battle.

Moreover, contractors are generally only liable for 12 to 24 months following project completion (this is known as the “Making Good of Defects” period, or MGOD. Beyond this, collateral warranties offer limited protection, making them unsuitable for the full lifecycle of most developments.

Why choose a Structural Warranty?

Developers should consider a structural warranty for long-term protection, which provides much more robust coverage. A structural warranty is a first-party insurance policy that covers the property owner against defects in design, materials, workmanship, and structural components for up to 10 years after project completion.

Here’s why a structural warranty is critical:

1. Financial Protection: A structural warranty covers the costs of rectifying defects without relying on contractor negligence or litigation, offering the client peace of mind.

2. Increased Marketability: Even if the property owner has no plans to refinance or sell the asset immediately, circumstances can change over the warranty period. A structural warranty is transferrable to new owners, enhancing the asset’s appeal to potential buyers or lenders.

3. Mortgage Lender Requirement: Most lenders will not approve a loan or refinance without a structural warranty. Without this warranty in place, future financial flexibility may be restricted.

4. Ease of Claim: Unlike collateral warranties, structural warranties allow the property owner to make claims directly with the insurer, bypassing the need for lengthy legal processes to prove negligence.

Key requirements for obtaining a structural warranty

To secure a structural warranty, the following steps are usually required:

• Inspection and Approval: The warranty provider must inspect and approve the property, often conducting multiple site visits at different stages of construction. For example, if your project has reached the foundation stage, it’s crucial to get a surveyor on site quickly. Delaying this process could lead to significant cost increases—up to 25% if the project progresses without approval.

• Compliance: The construction must adhere to current building regulations and best practices to qualify for the warranty.

• Certification: Upon successful inspection and completion, the warranty provider will issue a certificate that verifies the coverage.

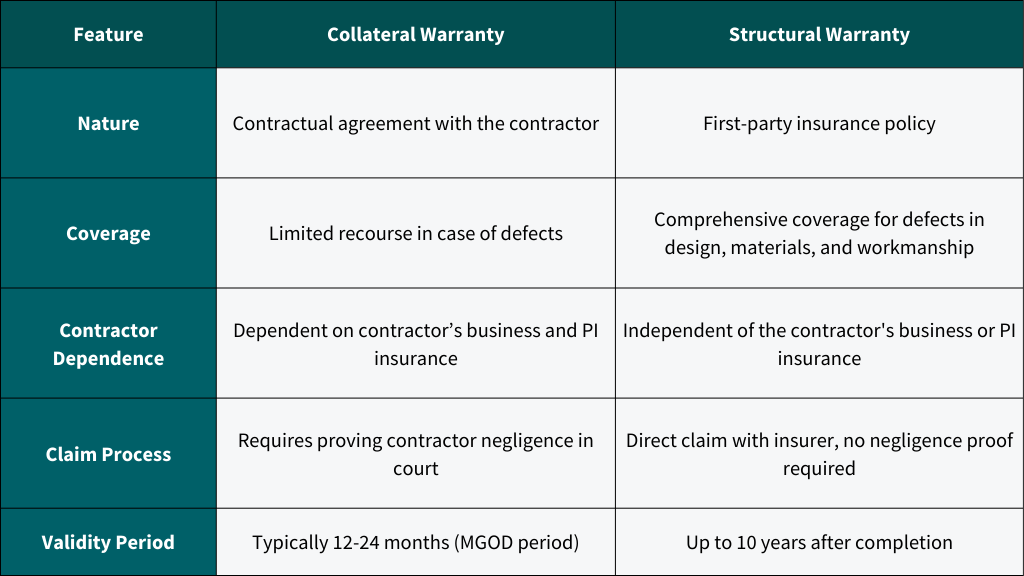

Collateral vs. Structural Warranty: A comparison

To further clarify the differences, here’s a quick comparison of the two types of warranties:

Next steps for developers

If you’re managing a significant development project, securing the right warranty is vital to safeguarding your investment and keeping the project on track. Delaying this decision can lead to increased costs, especially if the project progresses without proper inspections.

When it comes to safeguarding your project, a structural warranty offers more comprehensive coverage and more robust long-term protection. Not only does it protect your assets, but it also ensures financial flexibility, marketability, and peace of mind over the long term. Unlike a collateral warranty, which relies on proving contractor negligence and may not meet the needs of future lenders or asset finance providers, a structural warranty is a first-party policy that activates if defects occur.

Bespoke advice from a trusted advisor with construction and insurance expertise is essential for safeguarding your project. A tailored insurance solution addresses your development’s unique risks and challenges, ensuring you meet legal requirements and secure proper financial protection. Expert guidance from a specialist insurance consultant can help you avoid costly mistakes and provide long-term peace of mind, making your project more resilient and successful.

If you’re ready to move forward, London Belgravia Group’s experienced consultants can help you act quickly and instruct a structural warranty provider. Get in touch with Matt Percival today for impartial advice on the best warranty for your project.