The EWS1 form was designed following government advice regarding external wall systems on buildings above 18M and created to ensure that mortgage lenders would be comfortable that the cladding and external wall make -up was safe for occupiers and therefore safeguarding their funds and allow them to provide mortgages. Changes in Government advice in January 2020, bringing all buildings into scope, has meant that many residential buildings below 18m which have ‘specific concerns’, may now require an EWS1.

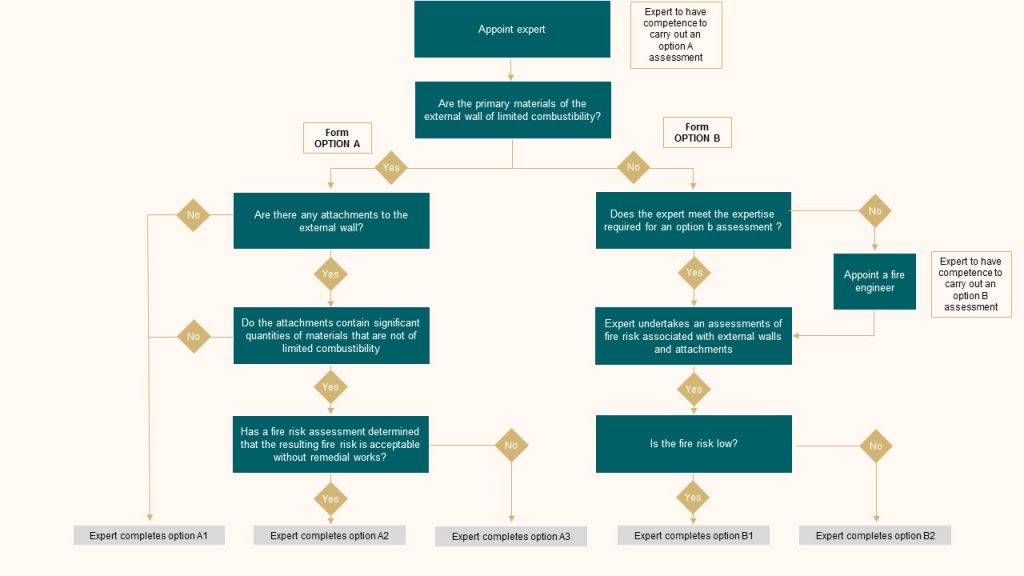

The External Wall Fire Review process requires a qualified professional to carry out a fire risk assessment on the buildings external wall system, before signing an EWS1 form, which is valid for the entire building (or single structure) for five years.

The lack of qualified professionals and difficulty within obtaining the professional indemnity insurance cover has caused a wide range of issues for new developments and existing developments when selling, refinancing or otherwise arranging any type of asset secured funding on applicable “in scope” developments.

Touch to enlarge

London Belgravia is pleased to announce that we are able to assist in obtaining EWS1 form certification for both not started and completed projects. We have partnered with a number of companies to offer the EWS1 service, and are able to confirm all of the partnered companies have the following necessary credentials:

Fully qualified professionals to carry out The External Wall Fire Review

Professional Indemnity Insurance in place

Potential to issue the EWS1 form service within ten working days

EWS1’s are changing the landscape for mortgage applications

We expect more lenders to require a clear EWS1 form for all building above 18M, including those buildings under 18M now considered “in scope” by the RICS, UK Finance and the Building Societies Association. In addition, the expectation is that it is likely to extend to include all multi-storey and multi-occupancy buildings in time. To be able to support our clients, we are now able to assist in the procurement of EWS1 forms, and The External Wall Fire Review process. If you have a requirement or wish to speak with a member of our team, get in touch.

Get In Touch

We will use the information provided to contact you about our products and services. You may unsubscribe from these communications at any time. For more information read our privacy policy.